santa clara county property tax rate

Property Taxes--Secured and Unsecured The County cities schools and other local taxing agencies derive a portion of their revenue from property. Full in-person customer service resumes in the Assessors Office.

Special Fund On Santa Clara County Property Tax Bill Pays For Employee Pensions The Mercury News

For questions about filing extensions tax relief and more call.

. The budgettax rate-setting process typically involves regular public hearings to debate tax issues and related budgetary considerations. Required Funds Educational Revenue Augmentation Fund ERAF Please refer to Demystifying the California Property Tax Apportionment System Chapter 5 Unapportioned Tax Fund Controls the tax charges receivable due to collected and prior to distribution Suspense funds for tax receipts collected by Tax Collector Tax receivables are recorded at the time the tax charge or. Information in all areas for Property Taxes.

Tax Rates are expressed in terms of per 100 dollars of valuation. A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that utilize the regular city or county assessment roll per Government Code 54900. Situated on the eastern shore of the San Francisco Bay Alameda County contains the cities of Oakland Berkeley and Fremont among others.

The median property tax on a 70100000 house is 736050 in the United States. This calculator can only provide you with a rough estimate of your tax liabilities based on the. Home Page Browse Video Tutorial Developers.

The median annual property tax payment in Santa Clara County is 6650. The average effective property tax rate in Santa Clara County is 075. The last point is important as Santa Clara Countys government has faced recent criticism for lack of transparency in its tax rate calculations.

County of Santa Clara. Those entities include Santa Clarita the county districts and special purpose units that make up that combined tax rate. A reassessed market value is then multiplied times a total levy from all taxing entities together to set tax due.

The median property tax on a 70100000 house is 518740 in California. Every entity establishes its individual tax rate. CDTFA public counters are now open for scheduling of in-person video or phone appointments.

If December 10 or April 10 falls on a weekend or County of Santa Clara holiday then the Delinquent Date is extended to the next business day. The median property tax on a 70100000 house is 469670 in Santa Clara County. This date is not expected to change due to COVID-19 however assistance is available to.

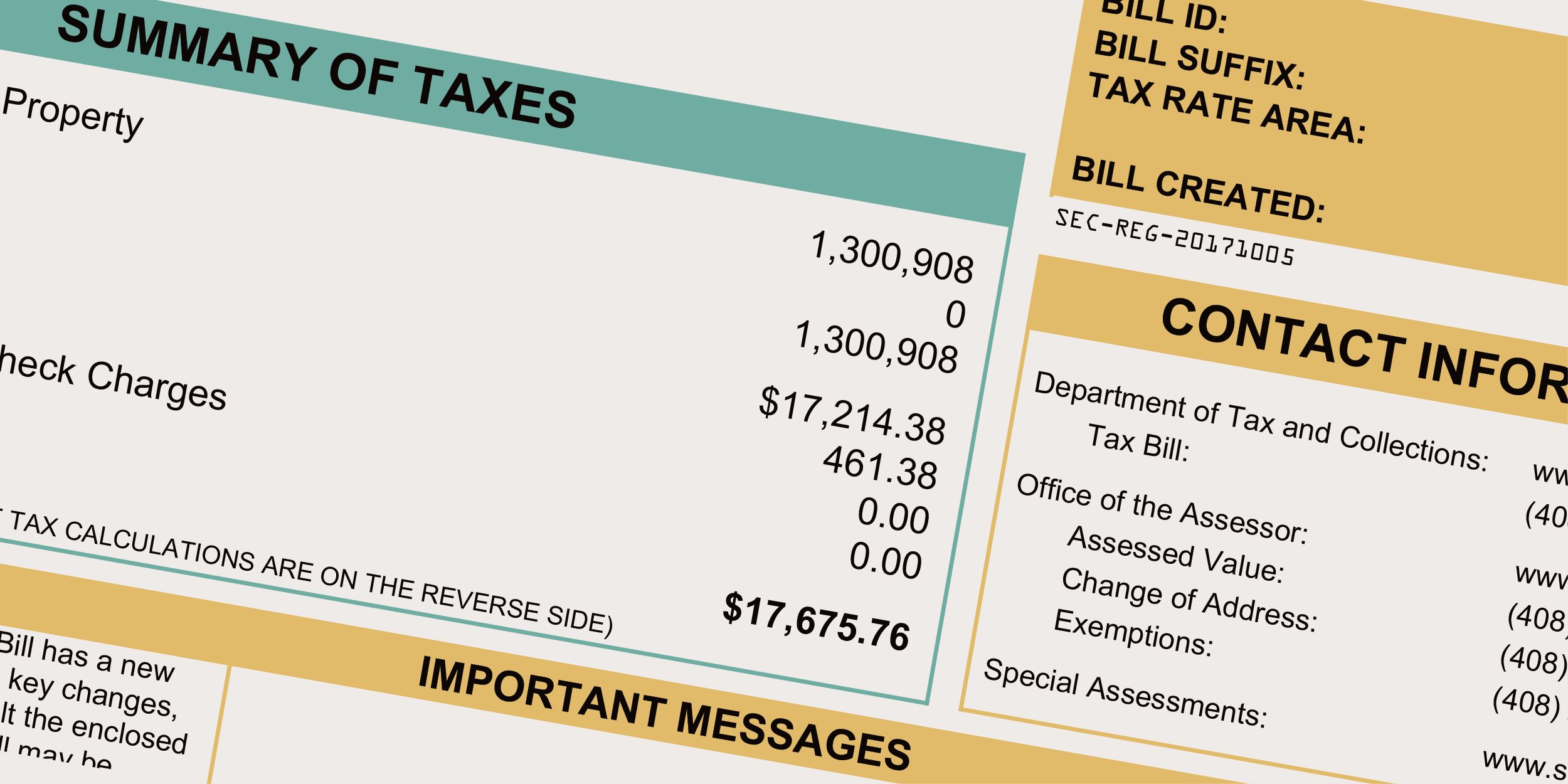

SANTA CLARA COUNTY CALIF The County of Santa Clara Department of Tax and Collections DTAC representatives remind property owners that the second installment of the 2021-2022 property taxes is due February 1 and becomes delinquent at 5 pm. Businesses impacted by the pandemic please visit our COVID-19 page. We offer drop-in or appointment service for visitors to the office.

Santa Clara County Assessors Public Portal. Property Tax Rate Book Property Tax Rate Book. COUNTY OF SANTA CLARA PROPERTY TAXES.

Compilation of Tax Rates and Information. Property taxes are levied on land improvements and business personal property. FY2019-20 PDF 198 MB.

Tax Rate Book Archive. Learn more about SCC DTAC Property Tax Payment App. Citizens with an annual household income of 35500 or less and 40 equity in their homes to apply to defer payment of property taxes on their principle residence.

Nearly all the sub-county entities have agreements for Santa Clara County to bill and collect their tax. In Santa Clara Countys case the tax rate equates to 0. The median property tax also known as real estate tax in Santa Clara County is 469400 per year based on a median home value of 70100000 and a median effective property tax rate of 067 of property value.

The property tax rate in the county is 078. Santa Clara County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax collections. Skip to Main Content Search Search.

Click to see full answer. On Monday April 11 2022. An appraiser from the countys office establishes your propertys worth.

The County of Santa Clara Department of Tax and Collections DTAC representatives are reminding property owners that the second installment of the 2020-2021 property taxes is due February 1 and becomes delinquent at 5 pm. Business and personal property taxpayers in Santa Clara County now have access to SCC DTAC a new mobile app launched by the County of Santa Clara Department of Tax and Collections to provide more than 500000 property owners with convenient access to pay their secured property tax payments. Pay secured property taxes online prior to midnight pacific time on December 10 and April 10 to avoid penalties.

Tax Rate Areas Santa Clara County 2021. Tax rates can be complicated even without a lack of transparency so it is easier to look at the tax rate as a percentage of property value. Please contact the local office nearest you.

Application forms for Prop 60 requests may be obtained by contacting the Real Property Division of the Santa Clara County Assessors Office or downloading the form below. Enter Property Parcel Number APN. The County of Santa Clara for the Fiscal Year 2020-2021.

But because the median home value in Santa Clara County is incredibly high at 829600 the median annual property tax payment in the county is 6183 the second highest in California behind Marin County. Online videos and Live Webinars are available in lieu of in-person classes. It limits the property tax rate to 1 of assessed value ad valorem property tax plus the rate necessary to fund local voterapproved debt.

FY2020-21 PDF 150 MB. However most business can be conducted by phone email or via web services. Proposition 13 the property tax limitation initiative was approved by California voters in 1978.

What You Should Know About Santa Clara County Transfer Tax

Santa Clara County On Twitter Sccgov Dept Of Tax And Collections Issues Announcement About Prepayment Of Propertytaxes Accepting Current Years S 2nd Installment Due April 10 2018 But Not Prepayment Of Future 2018 2019

Property Taxes Department Of Tax And Collections County Of Santa Clara

Property Tax Rate Book Controller Treasurer Department County Of Santa Clara

12335 Stonebrook Dr Los Altos Hills Ca 94022 Zillow Los Altos Hills Mansions Secret Rooms

Property Taxes Department Of Tax And Collections County Of Santa Clara

Home Market Still Sluggish Sacramento Business Journal Business Journal Marketing Titusville

Pin On Salinas California Homes Real Estate

Top 10 Counties With Equity Rich Properties Equity San Mateo County County

We Have Two New Communities Coming In May To Santa Paula A Charming City In Ventura County Touted As The Citrus Capi New Home Communities Eagle Homes Lennar

Property Tax Distribution Charts Controller Treasurer Department County Of Santa Clara

Vacation Rental Market Analysis St George Ut Vacation Rental St George Vacation

Property Tax Distribution Charts Controller Treasurer Department County Of Santa Clara